Healthcare Reform News

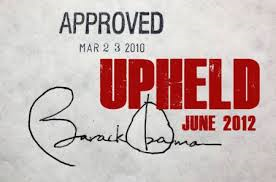

There has been so much talk and controversy about the Affordable Care Act. There were attempts to overturn it. The United States Supreme Court has upheld the law, and it is now starting to go into effect across the country.

There has been so much talk and controversy about the Affordable Care Act. There were attempts to overturn it. The United States Supreme Court has upheld the law, and it is now starting to go into effect across the country.

October 1st was the opening of the federal insurance exchanges. Because of this, I am presenting some relevant information for individual compliance with this federally-mandated health care and health insurance law.

This information is not intended to provide legal advice and it does not include all details found in the Act. I have received a summary from the Wyoming Department of Insurance, courtesy of Brian Sawyer at the Butler-Leavitt Insurance Agency, Inc in Cottonwood, AZ. You are encouraged to consult specific provisions of the Act and obtain advice from appropriate sources, as they are referenced.

This information is not intended to provide legal advice and it does not include all details found in the Act. I have received a summary from the Wyoming Department of Insurance, courtesy of Brian Sawyer at the Butler-Leavitt Insurance Agency, Inc in Cottonwood, AZ. You are encouraged to consult specific provisions of the Act and obtain advice from appropriate sources, as they are referenced.

What do I have to do because of this law?

Individuals are required to have minimum qualified coverage beginning January 1, 2014.

Individuals are required to have minimum qualified coverage beginning January 1, 2014.

What are the forms of qualified coverage?

- Government sponsored programs

- Medicare

- Medicaid

- CHIP

- TriCare

- Peace Corps volunteers

- Veteran’s healthcare program

- Employer sponsored coverage

- COBRA

- Retiree coverage

- Individual Market Coverage

- Grandfathered Coverage

- Other Coverage such as the State health benefits risk pool

Or else?

Or else – penalties.

Penalties are assessed per person, based on household income. Penalties for a child are half of what is assessed for an adult. They increase as the years go by.

Penalties are assessed per person, based on household income. Penalties for a child are half of what is assessed for an adult. They increase as the years go by.

2014 $95 per adult up to $285 or 1% of household income, whichever is higher

2015 $325 per adult up to $975 or 2% of household income, whichever is higher

2016 $695 per adult up to $2,085 or 2.5% of household income, whichever is higher

- Information on the Penalty from the Internal Revenue Service:

For Employers: http://www.irs.gov/uac/Newsroom/Questions-and-Answers-on-Employer-Shared-Responsibility-Provisions-Under-the-Affordable-Care-Act

For Individuals: http://www.irs.gov/uac/Questions-and-Answers-on-the-Individual-Shared-Responsibility-Provision

Unless you are exempt . . .

- Individuals who cannot afford coverage because it exceeds 8% of household income

- Taxpayers with income below the tax filing threshold (for 2013 this is $9,500 for singles under age 65 and $19,000 for couples under age 65)

- Certified Tribal members

- Individuals who qualify for religious exceptions

- Members of a healthcare sharing ministry

- Incarcerated individuals

- Individuals who are not lawfully present in the United States

- Individuals who are insured through a Government sponsored program

- Individuals who experience a short coverage gap of less than 3 months

What do I do?

- Keep what I have

- Purchase inside the marketplace

- Purchase outside the marketplace

- Do nothing (and pay a penalty unless exempt)

What are the benefits of the new health insurance offerings because of the reform?

“Guaranteed Issue” which means you cannot be denied or rated because of any health condition

“Guaranteed Issue” which means you cannot be denied or rated because of any health condition- No Pre-Existing Condition Exclusions

- Insurance Rating Guidelines: Can only charge a different rate for

- smoking

- age

- geographic area

- Essential Health Benefits & Cost-Sharing Must Meet Established Value Levels

-

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services, including behavioral health treatment

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventative and wellness services and chronic disease management

- Pediatric services, including oral and vision care

These apply inside and outside of a marketplace

Keep What I Have = Grandfathered Plans

Coverage in which individuals were enrolled prior to March 23, 2013 are exempt from most provisions of the bill.

Provisions that DO Apply:

- Lifetime limits

- Restrictions on rescissions

- Extension of dependent coverage

- Medical loss ratios

- Annual limits (group only)

- Preexisting condition exclusions (group only)

- Grandfather Status Can Be Lost

- Grandfathered plans will satisfy individual mandate

- Check with insurance agent or company to see if your current plan qualifies for grandfather status.

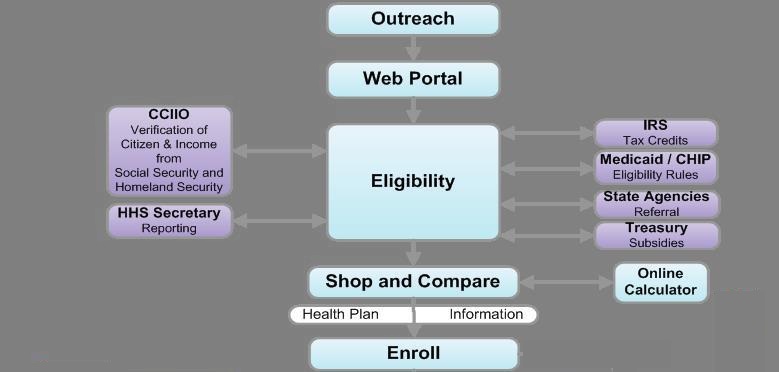

Purchase Inside the Marketplace

A Health Insurance Marketplace (formerly called an Exchange) is a virtual marketplace where “qualified individuals”can compare and

A Health Insurance Marketplace (formerly called an Exchange) is a virtual marketplace where “qualified individuals”can compare and

purchase health insurance policies (called “qualified health plans” or QHPs), either online or by calling in to a customer service center. January 1, 2014 is the earliest date coverage will be effective if purchased in a Marketplace.

- Virtual marketplace for an “apples to apples” comparison of benefits and costs

- Cost assistance is only available through the Marketplace

- Qualifies individuals for Medicaid, CHIP or premium subsidies

- Offers only qualified health plans and dental plans

- Two marketplaces

- 1 – Individuals

- 1 – Small Groups

- Three types of marketplaces

- State based

- Partnership

- Federally facilitated marketplace

Purchase Outside the Marketplace

- You can still purchase insurance directly from an insurance carrier.

- No subsidy or cost sharing reduction outside the marketplace

- Outside the marketplace companies may have products that will not qualify as minimum qualified health coverage (Tax penalty)

- Limited benefit plans

- Specific illness plans (cancer policy)

- Need to check with agent/company to see if plan satisfies the Federal mandate

- Contact agents/brokers/companies to purchase

- Insurers may restrict sales of new policies in the individual market to open enrollment periods that align with those for marketplaces.

Enrollment through the Marketplace

- On October 1, 2013 you can enroll for health insurance at: www.healthcare.gov

Initial open enrollment period will be October 1, 2013 – March 31, 2014.

Annual enrollment will occur between October 15 – December 7.

The Marketplace is responsible for determining the date the special enrollment period begins. Special enrollment triggers include:

- An individual or dependent losing minimum qualified coverage;

- An individual gaining or becoming a dependent through marriage, birth, adoption, or placement of adoption;

- An individual experiencing an error in enrollment;

- When a plan or issuer substantially violates a material provision of the contract in which the individual is enrolled;

- An individual becomes newly eligible or newly ineligible for subsidies or a change in cost-sharing reductions; or

- When new coverage becomes available as a result of a permanent move.

Qualified Health Plans (QHP)

Qualified health plans (QHPs) are health insurance policies or plans that:

- Meet specified actuarial value levels – bronze, silver, gold or platinum, and

- Provide coverage for a core set of 10 benefits and services called “essential health benefits”, and

- Include specified limits on deductibles and cost-sharing, and

- Are priced based on only four risk adjustment factors.

Specified Actuarial Value is a measure of the plan’s generosity. It is the percentage of the overall cost or value of covered benefits that is paid by the plan (or insurer) rather than by the participant.

For example, in a silver level plan, the plan or insurer would pay, on average, 70% of the cost, and the participant would pay 30%. The participant’s share is paid through “cost-sharing” such as deductibles, co-pays, coinsurance and other out-of-pocket amounts, but does not include amounts paid for premiums.

- Platinum = 90% value (Insurance should pay 90% of covered health care costs)

- Gold = 80% value

- Silver = 70% value

- Bronze = 60% value

- Catastrophic Plan (limited to young and those without affordable option in the market)

Plan Design

- A child-only plan must be offered at the same metal tier as any health plan that the issuer offers.

- Limited to individuals who are under age 21 as of the beginning of the plan year.

- A catastrophic plan is available to individuals who are under age 30 or who are exempt from the individual mandate due to a hardship or where cost of coverage, exceed 8% of income.

- Each issuer selling in the marketplace must offer at least one silver level, one gold level, and a child-only.

Subsidies

The first requirement is that the subsidies only apply to qualified individuals who purchase health insurance in the individual Marketplace, not to insurance purchased outside the individual Marketplace.

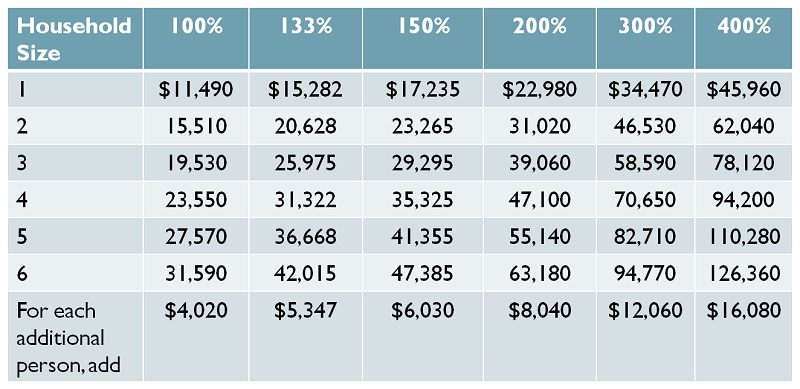

Second, the subsidies are only available to “qualified individuals” – defined as U.S. citizens or lawful residents with household income equal to 100%-400% of the Federal Poverty Level, who are not eligible for government health benefits (such as Medicare, Medicaid, SCHIP, Tri-Care or others) and not eligible for “affordable” employer-provided coverage that provides at least “minimum value” (defined as 60% actuarial value, as noted previously).

See below for a table of FPLs dollar amounts by household size. Note that individuals who have affordable employer-based coverage available are not eligible for subsidies if they decline the employer coverage. They can purchase coverage in the Marketplace, but they will not be eligible for a subsidy. The “affordability” test is: the employee cost for self-only coverage cannot be more than 9.5% of household income.

Based only on household size and income, the following individuals will be eligible for subsidies in 2014 (this is based on household incomes of 133%-400% of the FPL, as detailed in the table below):

- Individuals with an annual household income of $15,282 – $45,960

- Couples with an annual household income of $20,628 – $62,040

- Family of four with an annual household income of $31,322 – $94,200

What kind of subsidies are there for purchasing health insurance in the individual Marketplace?

1) Advanced Premium Tax Credit (APTC): The advance premium tax credit helps individuals and families afford the premium for health insurance. The federal government pays a specified amount each month directly to the health insurer in whose policy the individual and/or family members have enrolled.

Enrollees do not have to pay the full premium and then request reimbursement from the government when they file a tax return after the end of the year. The premium assistance amount is applied when the individual or family first enrolls, and each month they pay only the net premium amount (i.e., the total premium minus the federal subsidy).

The APTC amount is calculated using a formula that is based on:

- The premium for the second-lowest cost silver plan (for a particular individual based on geographic area, age and family tier), and

- The individual’s household income above the tax filing threshold amount.

The second lowest-cost silver option is called the “benchmark” plan. If a family or individual chooses a plan that is less expensive than the benchmark plan, the net cost will be less, but no one will be eligible for a refund by choosing a lower-cost plan.

2) Cost-sharing Reductions: “Cost-sharing” is the amount an enrolled individual pays for deductibles, co-pays, coinsurance and other out-of-pocket costs for in-network services. It does not include amounts paid for premiums, out-of-network services, or non-covered expenses. Cost-sharing reductions are available only to individuals with household incomes up to 250% of the FPL who buy the silver level plan. The lower the income level, the higher the cost-sharing reduction. Two examples, from “Covered California’s 2014 Sliding Scale Plans – Single Person”:

- If the primary care office visit co-pay is $45, individuals with household incomes of 200% and 150% of the FPL would pay only $20 and $4, respectively.

- If the regular out-of-pocket maximum for an individual is $6,350, individuals with household income of 100-250% of the FPL would pay only $2,250.

These cost-sharing reductions might increase the actuarial value of an individual’s health insurance policy, in some cases increasing a silver level plan to a gold plan.

This table shows the dollar amounts of the FPLs for various household sizes. It applies in the 48 contiguous states, and separate tables apply for Alaska and Hawaii.

TMI? Too Much Information?

This is a lot of random information, attempting to get you familiar with the Healthcare Reform possibilities. Please consult the government website or call 1-800-318-2596. Better yet, make an appointment with a qualified insurance agent to choose your healthcare insurance.

I recommend Butler-Leavitt Insurance Agency, Inc in Cottonwood. Ask for Brian Sawyer. There is also more information on their website at http://www.leavitt.com/healthcarereform/

Stay up-to-date: subscribe to the Butler-Leavitt newsletter at the website.

Stay up-to-date: subscribe to the Butler-Leavitt newsletter at the website.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE?

You can, as long as you include this complete blurb with it: “Naturopathic Physician Dr. Cheryl Kasdorf is a doctor who listens and has answers with a natural approach that works. She is known as the go-to person to get back your get-up-and-go when it is gone, gone, gone. Get your FREE gift “Dr. Kasdorf’s Health Secrets for Feeling & Looking Great” at drcherylkasdorf.com